Enter a Recurring Journal Entry

This routine is used for Transactions (Journal Entries) that Repeat every month. An example is a company charge that is to be billed to Investors every month for something like Administrative Costs of Wells. If they are not Recurring Each Month use the normal Add Journal Entry routine - the process is the same.

Recurring Transactions are stored seperately from the Monthly Transactions. To add them to the Monthly Transaction, you must Append Recurring Transactions to the Monthly file.

TUTORIAL SCENARIO

Let's assume that every month, we charge our Investors $100 for Administrative Charges for some Well #1. This charge arises every month. To keep from having to enter it every month, we will enter it Once in this routine, then after we Close each Month we will Append All of the Repeating Transactions into the Monthly Transaction File. This procedure lets us enter charges like this, and then only once a month, we Append all these charges to the Monthly Transaction file.

We will add a $100 monthly recurring charge for Well 10000. This charge will then be appened each month, and billed to the Investors when Operating Statements are printed.

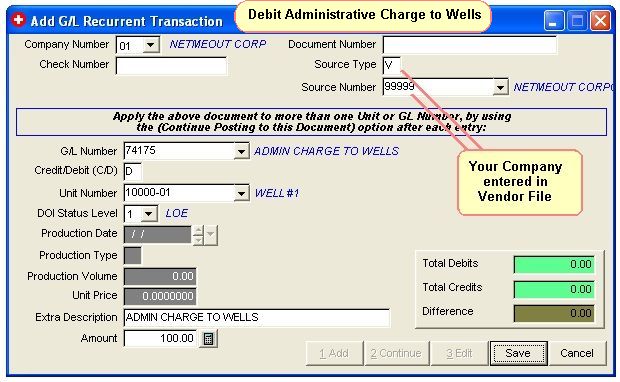

We will Debit Administrative Charges to Wells (GL Number 74175) See GL Number Restrictions

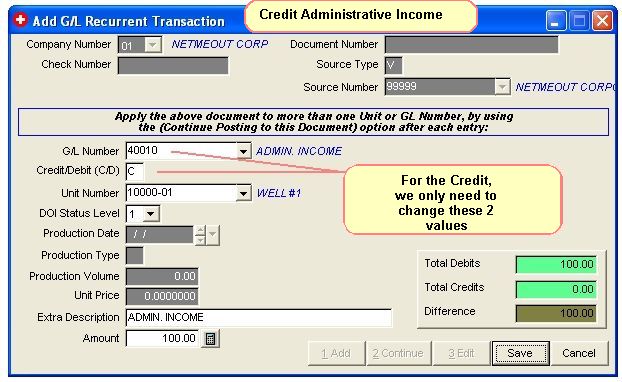

We will Credit Administrative Income (GL Number 40010)

Note: These charges are expenses to the Investors but are Income to your company.

ADD RECURRING JOURNAL ENTRIES FOR A COMPANY CHARGE TO BE BILLED TO INVESTORS

From the Quick Menu, select Transactions, then Add GL Recurrent Trans.

Enter the Debit as shown in the image above.

Note on Source Type and Number: If the Source Type is "V" for Vendor and you enter a Vendor Number, the Vendors Name is printed on the Operating Statements.

Note: Some operators like to have their Company Name printed as additional description for the transaction to the Investors. For example, if you entered your Company name in the Vendor file for Vendor Number "99999" you could have your company name printed automatically on the Operating Statements by entering "V" for Source Type and "99999" for Source Number.

Note: The first time Recurrent Transactions are added, you must append the new entries to the Transactions file using the 'Append’. After the first time, Recurrent Transactions are normally appended to the Transaction file after each period is closed to set it up for the new period.

Click Save. Then click Continue and we will enter the Credit for the transaction.

Complete the entry for the Credit to Sales as shown in image above.

Click Save, then Click Exit.

You are finished entering a Company Charge for Investors into the Recurrent Transaction file.

Recurring Transactions are stored seperately from the Monthly Transactions. To add them to the Monthly Transaction, you must Append Recurring Transactions to the Monthly file.

To see a listing of Recurrent Transactons

Select Transactions - Recurrent - Edit/Delete

Set the Filter, then click the Print Button.

FILES UPDATED

TRANP.DBF - Stores debits and credits for recurrent transactions entered.

When the transactions are appended, they are added to the

TRAN.DBF - Debits and credits for the Month (Period)

Related Topics

How to Edit/Delete a Recurring Transaction ~ Append Recurring Transactions to the Monthly File ~ Accounting for Dummies ~ GL Number Restrictions ~ How to use Recurrent (Repeating) Accounts Payable Invoices

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.